Disability Income Insurance for University of Washington Medical Residents and Fellows

This page outlines our approach to placing Disability Income (DI) insurance for University of Washington Medical Residents and Fellows. In a marketplace where policy language is complex underwriting is demanding, Residents and Fellows may find this helpful guidance in making a prudent buying decision.

Although product availability changes from year to year, we continue to base purchase recommendations on the same four (4) criteria:

-

Ability to qualify for future upgrade options

-

Carrier reputation

-

Guarantees and features

-

Pricing

Let's discuss each of these briefly.

Ability to Qualify for Future Upgrade Options

Insurers need to know individual medical history and lifestyle in order to know how far they can go with guarantees and features, and at what cost.

The need for personal information just to gather options adds unwelcome friction to the process. To get around this, insurers offer standard issue pricing (i.e., not determined by health) which is made possible by not including certain guarantees and features, the most important of which relates to future upgrades to keep pace with rising earnings.

For this reason, healthy medical residents should look to fully underwritten options first, with the intent to set themselves up for future upgrades for the remainder of their career so that they don't ever have to go through medical underwriting again. Insurers are generally willing to keep the door open future upgrades without underwriting in future years, but only if they get a chance to underwrite for health at policy inception.

Carrier Reputation

The carrier's reputation is especially important for disability income coverage because it is designed to be held for an entire career and claims are complex and potentially subjective. The carrier itself is just as important as the policy language because it is felt with every interaction and is predictive of the overall reliability of the promise.

The difficulty here is that reputation is not measurable, and anecdotal stories based on observation are not rigorous. Nevertheless, some effort must be made to account for carrier reputation, even if it relies on just signals.

Some of these signals include financial ratings, mutuality (mutual companies don't have stockholders), complaint ratios, and perhaps anecdotal stories. They tend to move together.

Guarantees and Features

Medical residents not only need disability insurance, but they need a particular kind of disability insurance with suitable guarantees and features like:

-

A definition of disability that is specific to medical specialty and/or revenue sources. For example, if you were disabled as a cardiologist and your revenues come mostly from procedures that you can't do any more, you would want that to be sufficient to qualify you for Total Disability benefits even if you could theoretically still work as a physician more generally.

-

True own occupation coverage. "True" refers to the absence of the "not working" requirement, enabling a person to earn money on the side - while on claim - without jeopardizing benefits. This provides an easier path to qualify as Totally Disabled, which is the most favorable type of claim because Total Disability benefits are paid out as the full fixed dollar monthly indemnity amount with no formulaic reductions. The freedom to work on the side without a ceiling on those earnings is important because disability benefits are sometimes inadequate to support the desired lifestyle. That's the economic reason. Also, there is a very strong psychological reason in play which relates to the role of career in shaping one's self-identity. That age old question of who am I will always be, at least partially, determined by occupation. "True" own occupation coverage allows a physician to pivot their career rather than losing it altogether.

-

Strong guarantees that prevent loss of coverage or a recalculation of potential benefits. As you are probably aware from experience, people tend to work less in the time period leading up to claim which can be years in the making. When a health issue comes into view, it is important that there be a guarantee that no portion of coverage will be lost due to earning less or working less. In other words, you don't want it to float down. That's why policies that are designed to pay fixed dollar monthly indemnity benefits are superior to formula-based benefits.

-

Benefits that are paid independent of other sources. This means that the benefit is fixed, regardless of any other available sources such as group LTD, Social Security, retirement draws or court settlements and judgments. This is important in order to have true security and choice, and also to retain one's sanity during claim. Also, consider that it is common to change employment several times over the course of one's career. DI benefits should be completely separate from any group LTD offered by the employer of the moment (group and individual policies usually don't integrate with one another).

-

Future increase options, which permit the policy to be upgraded as earnings rise. With substantial increases in earnings on the horizon, residents absolutely need this. There are many complex considerations here, such as whether an individual can qualify for it, the timing of option window intervals, use-it-or-lose-it rules, maximum age, and whether additional layers will be attached to the existing policy as opposed to new policies. It is the finer details that make this feature useful or not.

It matters a great deal how the carrier executes future increase options. The mere existence of a future increase option is not sufficient.

Pricing

Considering the stakes involved, it is important to be frugal without being cheap. Your earnings are too important. We want to focus on value in a way that doesn't trade away quality, such as:

-

Special discounts for UW medical residents and fellows, of course.

-

Relaxed eligibility in terms of the when a person can apply and still be eligible for discounts. Ideally, any special deals would remain available during one's entire residency, not just at the very beginning.

-

Lasting discounts that continue after residency - preferably for one's entire career. These are sometimes referred to as "sticky" discounts or "permanent" discounts.

-

Discounts that apply to future upgrades, not just the initial purchase. Because the bulk of coverage will probably be added after completing residency, we want those layers of coverage to get the discount as well. The applicability of discounts to coverage acquired in the future is way more important than the initial discount because most of the volume is yet to come.

-

Low initial entry cost options, possibly by taking advantage of a graded premium option or a smaller policy that is still eligible to be built up over time. Residents have very little income and so the priority is usually just to lock down one's future insurability for the minimum cost today.

-

Premium guarantees that lock in the terms for a full career. This is part and parcel of what the industry calls non-cancellable coverage, which means the policy won't come up for renewal nor will the premium change until some age like 65.

Is There a Recommended Product?

Not without health information. There is no single product that is best for everyone, mostly because insurers have different risk tolerances toward any given health history, but also because they structure their offerings in different ways.

If you are just educating yourself and want to see an example of what a high quality DI insurance product looks like, MassMutual is an excellent starting point. Just don't get your heart set because your personal history may lead us down a different path.

Choosing the Right Company

Highlights MassMutual's financial ratings, history of meeting financial obligations, and the value of a mutual company.

For use in the following states: AL AK AR AZ CA CO CT DC DE FL GA HI IA ID IL IN KA KY LA MA MD ME MI MN MO MS MT NC ND NE NH NJ NM NV NY OH OK OR PA RI SC SD TN TX UT VA VT WA WI WV WY

di1904rc 1124

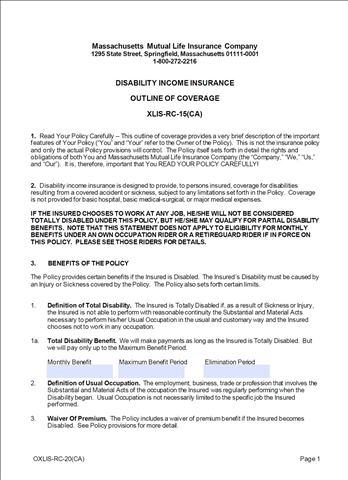

Protecting Your Medical Occupation

Overview of the own occupation definition of disability - with specialty language - for medical and dental occupations.

For use in the following states: AL AK AR AZ CA CO CT DC DE FL GA HI IA ID IL IN KA KY LA MA MD ME MI MN MO MS MT NC ND NE NH NJ NV NY OH OK OR PA RI SC SD TN TX UT VA VT WA WI WV WY

di85001 rev 7-24

Extended Partial Disability Benefits Rider (EPR)

Highlights how benefits are triggered and calculated under the EPR rider, which provides benefits while disabled and working. EPR is available by optional rider, for additional cost.

For use in the following states: AL AK AR AZ CO CT DC DE FL GA HI IA ID IL IN KA KY LA MA MD ME MI MN MO MS MT NC ND NE NH NJ NM NV NY OH OK OR PA RI SC SD TN TX UT VA VT WA WI WV WY

di2613 v624

Student Loan Rider

An overview of the Student Loan Rider which protects income earmarked for student loan payments on highly affordable basis with more relaxed financial qualification.

For use in the following states: AL AK AR AZ CA CO CT DC DE FL GA HI IA ID IL IN KA KY LA MA MD ME MI MN MO MS MT NC ND NE NH NJ NM NV OH OK OR PA RI SC SD TN TX UT VA VT WA WI WV WY

di1975 322

Your Guide to Filing a Disability Claim

A preview of what to expect to get a claim started, including how to start, what documentation is required, how long it takes, and other frequently asked questions regarding disability claims.

For use in the following states: AL AK AR AZ CA CO CT DC DE FL GA HI IA ID IL IN KA KY LA MA MD ME MI MN MO MS MT NC ND NE NH NJ NM NV NY OH OK OR PA RI SC SD TN TX UT VA VT WA WI WV WY

di1938

Consumer Underwriting Guide

An overview of what may be involved when applying for a policy, including some of the sources of information MassMutual uses to underwrite and determine pricing.

For use in the following states: AL AK AR AZ CA CO CT DC DE FL GA HI IA ID IL IN KA KY LA MA MD ME MI MN MO MS MT NC ND NE NH NJ NM NV NY OH OK OR PA RI SC SD TN TX UT VA VT WA WI WV WY

di1073

This will need to be further developed, as your personal qualifications will determine what is available to you, and at what cost. The additional information required relates to:

How you work, including any specialized work you perform within your occupation and skill sets you depend on to perform at the top of your game. To make this easy, you'll be prompted about specific things.

How established you are in your career

Career expectations, especially if a path to future upgrades is desirable

Earnings

Other existing disability coverage, if any

Lifestyle (e.g., travel habits, recreational activities)

Health

Where you are in this journey, including other inquiries, and

What underwriting requirements you prefer to avoid.

There are different ways to provide this information. You can call, answer questions by intake form or send a note. Health information cannot be provided using the intake form method. You won't have to provide any information that you don't want to, and what you do share will stay just between us.