When is 60% not 60%?

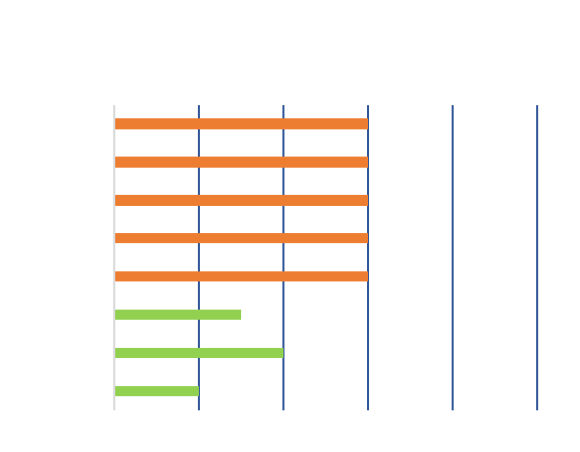

Group Long Term Disability insurance benefits are limited by the type and amount of insured compensation. LTD does not typically insure bonus, commission, equity-based pay, retirement contributions, or other variable compensation. Also, group insurance benefits are subject to an absolute monthly cap such as $10,000 per month.

As a result, the actual benefits for some employees pencil out to less than 60%.

To restore parity of income replacement ratios, individual disability insurance policies are issued - as a supplement - on the affected employees. There is no need to cover everyone.

Get Closer to 100% Income Replacement

Voluntary IDI and Executive IDI programs can go beyond restoration by increasing income replacement ratios above 60%, seeking to get as close to 100% as possible.

People need more than 60% to maintain lifestyle and meet financial obligations to loved ones. Making ends meet on just 60% is more challenging that it sounds due to the new expense of COBRA health insurance premiums and loss of retirement plan contributions and matches when no longer actively at work.

Could you afford the additional expense of COBRA premiums?

Having to absorb COBRA premiums on top of already challenging 40% pay cut can cause a financial tailspin, especially with a family to support.

Additionally, forced early retirement carries real financial consequences. If 401(k) contributions are suspended during a period of disability (and by law, they are), what is a person to live on when disability benefits end?

Until a person can afford to retire, all earnings are essential.

What Replaces Retirement Contributions?

Forced early retirement is serious. To stay on track, supplemental disability insurance can be designed to get person to 100% income replacement. Learn more...

Supplemental Disability Income insurance mitigates these problems by getting employees closer to replacing 100% of earnings.

Group LTD is Not Enough. But Why?

Group LTD is optimized for the purpose of keeping employer costs down, not for individual financial security or choice. To achieve this, group insurers rely on formulaic adjustments to keep the benefit down and contractual authority to force work changes, even if those changes require employees to compromise on job satisfaction and earnings.

Learn more in our blog post:

Supplemental IDI Uses Individual Policies

With Supplemental Disability Income insurance, each employee is issued their own individual policy, which is portable. It has to be this way in order to prevent group benefits from being offset.

When an employee departs, the insurance company redirects the bill to the individual for the same premium, but the individual can always choose to let the policy lapse. Going forward, the policy does not depend on the sponsoring employer in any way.

Each policy is individually curated by the insurer based on a snapshot of exposed earnings (that is, what group LTD is not insuring).

Individual policy benefits are not based on a percentage of earnings. Rather, they pay a specified fixed-dollar monthly indemnity benefit (for example, $10,000 per month) independent of any other benefit sources the individual may receive. The size of each policy is periodically upgraded to keep pace with rising earnings, though it is never downgraded even if compensation declines.